Business Insurance 101 for Music Teachers, Part 4: Musical Instruments

Deborah H. How

MTNA Business Digest, Volume 3, issue 4

July 2024

Insurance is an essential part of running any business. This four-part series takes a deeper look at insurance for music teachers. In this issue, Part 4 continues with a focus on musical instrument insurance. Click here for Part 1 (overview), here for Part 2 (general liability insurance) and here for Part 3 (professional indemnity, sexual abuse and molestation insurance).

Did you know that most homeowners/renters insurance policies and personal property insurance riders/floaters (endorsements) do NOT cover the business/professional use of an instrument? This is a surprise to many independent private music teachers who teach out of their homes.

In their 2021 post “Music to my ears: Coverage considerations for musical instrument insurance (Part I of II) for Reed Smith’s The Policyholder Perspective (a blog authored by a global team of insurance recovery lawyers), Adrienne N. Kitchen and John Vishneski write:

Professional musicians, including music teachers, are those who hold a job, make a living, or receive monetary compensation for playing a musical instrument. Because professional musicians make an income playing their instrument(s), such instruments are considered business property and are excluded from coverage under homeowner’s or renter’s policies (Kitchen & Vishneski 2021).

Homeowners/Renters Insurance

Most Homeowners/Renters Insurance do have a musical instrument allowance under personal property coverage, but many policies have 1) a “sub-limit” for musical instruments, which may be well below the cost of your musical instrument; and 2) only protect personal property against covered “perils,” such as fire, lightning, theft, and vandalism. Moreover, most homeowners/renters insurance policies do not cover business/professional use of said personal property, including musical instruments.

Nationwide, in their post “Home insurance resources: What you should know about insurance for musical instruments” states:

You might not need a separate musical instrument insurance policy to get covered. Musical instruments can be insured under homeowners or renter’s insurance, though it’s important to find out coverage details. These policies have a limit for the home’s total property damage and may have a limit per item. The per-item coverage may be lower than your musical instrument costs. In addition, the homeowners or renter’s policy only covers damage from “named perils” such as fire and theft, but not flood. One option for enhancing the protection for musical instruments under your home property insurance is to get a rider, sometimes called an endorsement, floater or scheduled personal property. This policy add-on provides additional coverage for specific valuables. A rider may have a lower deductible than the homeowners policy. Such riders usually are “all risk” providing much broader protection than “named perils.”

Also, not all homeowners insurance riders cover instruments for professional musicians, since there’s a higher chance of damage or loss. In that case, a commercial musical instrument policy is advised (Nationwide n.d.).

Moreover, according to The Zebra, a company that helps people compare insurance policies, the standard sub-limit on a homeowners/renters insurance policy for musical instruments is $2,000. (Martin 2024). If your deductible is around $1,000, then you will only be able to recoup $1,000 for your damaged (“named perils”) instrument. Since most professional instruments are worth much more than this, you will most likely need more coverage.

Personal Property Insurance Riders/Floaters (Endorsements)

Personal Property Insurance Riders/Floaters are additional endorsements that cover excluded specialty items on homeowner/renters insurance policies, such as musical instruments, and may 1) increase coverage limits, 2) offer more comprehensive coverage, 3) allow for lower or no deductibles (Lee 2021).

However, most personal property insurance riders/floaters (endorsements) also do not cover business/professional use of musical instruments. If, though, you teach at a music conservatory outside your home, but you have a piano at home only for personal use—i.e., you don’t teach lessons/collect tuition using your piano at home—a personal property insurance rider/floater that schedules your piano at home on a separate endorsement may be enough.

Scott Indrisek, writing for Lemonade, a fully licensed and regulated insurance company, offers extra coverage for musical instruments as an add-on to their homeowners/renters insurance policies:

And at Lemonade, you can also add what we call Extra Coverage for your most important things. That’s a nicer name for what the insurance biz calls “scheduled personal property coverage.” Extra Coverage is an add-on to your base renters or homeowners policy that’s meant to provide additional insurance perks for things like cameras, jewelry, bicycles, artwork, and musical instruments.

There are various perks to Extra Coverage: you won’t pay any deductible on your claims; you could be covered for higher dollar amounts; and you’ll also be set for things your base policy doesn’t cover, like accidental damage or loss (Indrisek n.d.).

But given the question: If I make money using my musical instruments, am I eligible?

Indrisek answers: No.

This is an important one. You can only apply Extra Coverage to your musical instruments if they’re for non-professional use. That’s why in some of the examples above we kept stressing that the hypothetical gigs and concerts were ‘free’ shows.

Now, you might not think of yourself as a professional musician. You don’t make your entire living recording or playing gigs, and you consider it more of a fun hobby that earns a few bucks on the side. But if you make any income from your music, that would technically classify the use of your instruments as being for business, and therefore not eligible for Extra Coverage (Indrisek n.d.).

Musical Instrument Coverage (stand-alone policy), unlike homeowners/renters insurance and/or homeowners/renters insurance, covers 1) professional usage, 2) breakage, 3) damage while traveling or caused by earthquakes/floods (Clarion n.d.).

For teachers with pianos, a stand-alone musical instrument insurance policy that covers professional use is likely necessary to protect your piano. For non-piano instrumental teachers, a stand-alone policy is recommended to protect your instrument when you travel to gigs or students’ homes.

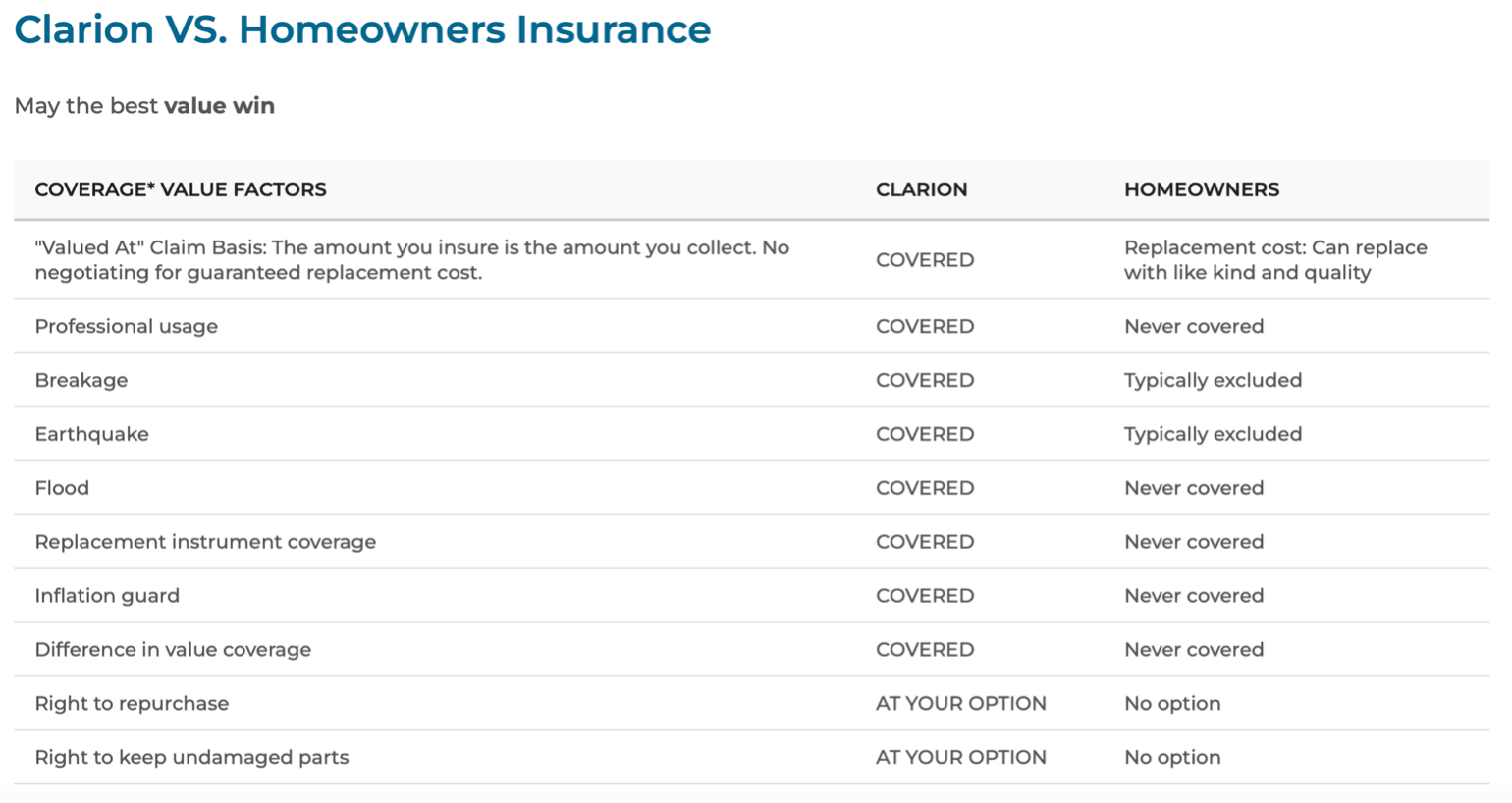

Clarion Associates, an insurance company—and MTNA partner—that specializes in insurance products for musicians, offers this chart when comparing their stand-alone musical instrument policy to standard homeowners insurance (Clarion n.d.):

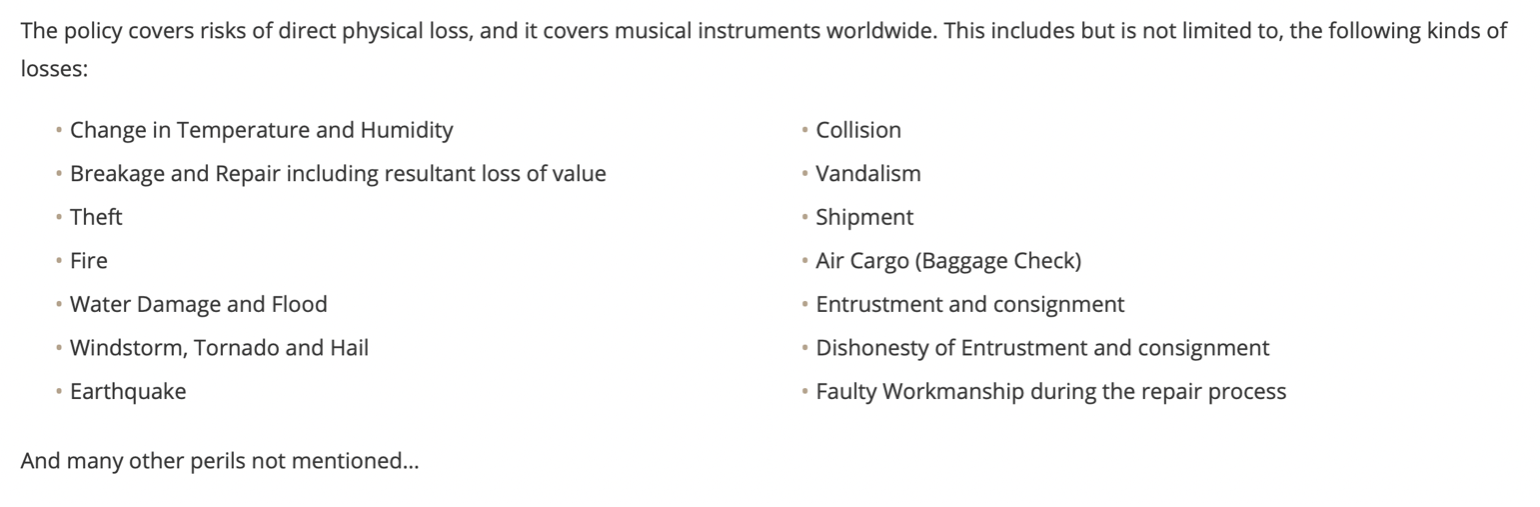

Heritage Insurance Services, another insurance company that offers stand-alone musical instrument policies for professional use, offers this list (Heritage n.d.):

Anderson Musical Instrument Insurance Solutions, another company that offers stand-alone musical instrument coverage which includes professional use offers Anderson Signature Instruments Insurance with inclusions and options such as diminished value coverage, flood and earthquake coverage, performance interruption coverage, shipping insurance, rental reimbursement, and musical scores coverage (Anderson n.d.).

So if you are thinking about adjusting or upgrading your insurance to cover professional use of your musical instrument, John Egan, in his article for Rolling Stone, “How Homeowners Insurance for Musical Instruments Could Help: If you have a particularly valuable instrument, your standard homeowners insurance may not be enough to cover loss or theft,” provides an excellent overview of what to look for and what information you should collect before shopping for an insurance policy that covers your musical instrument (Egan 2021).

References

Anderson Musical Instrument Insurance Solutions. n.d. “Anderson Signature Instruments Insurance Program.” Accessed June 1, 2024. https://anderson-group.com/musical-instrument-insurance/

Clarion. n.d. “Keep your Instruments Safe: Clarion vs. Homeowners Insurance.” Accessed August 15, 2023. https://www.clarionins.com/InformationCenterclarion.aspx?id=0

Egan, John. 2021. Rolling Stone, “How Homeowners Insurance for Musical Instruments Could Help.” August 20, 2021. https://www.rollingstone.com/product-recommendations/finance/theft-music-instruments-homeowners-insurance-1214015/

Heritage. n.d. “Coverage: Players & Collectors.” Accessed June 1, 2024. https://musicins.com/appraisals-and-valuations

Indrisek, Scott. Lemonade, “Musical Instrument Insurance, Explained.” Accessed June 1, 2024. https://www.lemonade.com/renters/explained/musical-instrument-insurance-explained/

Kitchen, Adrienne N. and John Vishneski. 2021. Reed Smith, “Music to my ears: Coverage considerations for musical instrument insurance (Part I of II). October 18, 2021. https://www.policyholderperspective.com/2021/10/articles/insurance-coverage/music-to-my-ears-coverage-considerations-for-musical-instrument-insurance-part-i-of-ii/

Lee, Rhonda. Edited by Sarah Silbert. 2021. Business Insider, “What are homeowners insurance endorsements and floaters?” December 2, 2021. https://www.businessinsider.com/personal-finance/homeowners-insurance-endorsements-riders-floaters

Martin, Ross. 2024. Edited by Kristine Lee. The Zebra, “Musical instruments and homeowners insurance.” Updated June 18, 2024. https://www.thezebra.com/homeowners-insurance/coverage/musical-instrument-insurance/#:~:text=Are%20your%20instruments%20covered%20while,used%20in%20a%20professional%20capacity

Nationwide. n.d. “Home insurance resources: What you should know about insurance for musical instruments.” Accessed June 1, 2024. https://www.nationwide.com/lc/resources/home/articles/musical-instrument-insurance

Deborah H. How, PhD, MBA is a connection builder/fundraising architect for nonprofit music organizations. She is the owner of Westside Music Conservatory, CEO of Musical Etudes and member of the MTNA Business Resource Network.