In the Spotlight:

Records, Receipts and Write-Offs: Taxes Made Simple for Music Teachers

Ashley Danyew

MTNA Business Digest, Volume 4, Issue 2

January 2025

You may not have set out to start a business when you started teaching music. But when you’re self-employed—even if it’s only part-time—that’s exactly what you’re doing. And managing the financial side of things (bookkeeping, tracking receipts, paying taxes, managing write-offs and more) is key to keeping your business on track.

In this article, you’ll find practical tips to get—and stay—financially organized all year. We’ll cover six financial tasks to do each month, a guide to calculating and paying estimated taxes each quarter and strategies to make the most of tax write-offs as a self-employed musician.

Disclaimer: This content is for educational purposes only and should not be construed as financial or tax advice. The information provided in this article is not a substitute for advice from a qualified professional who is aware of the facts and circumstances of your individual situation. Please seek advice from a financial or tax advisor familiar with your specific situation.

Monthly—

How to Be Your Own Bookkeeper

If you’re the only one working in your business, which is the case for most sole proprietors, you wear all the hats, including accountant!

You can always outsource this down the road, but I recommend learning the basics of bookkeeping and doing it on your own first so you’re aware of how money moves through your business.

Let’s start by talking about how to set up your business bank accounts.

Setting Up Your Business Bank Accounts

At a minimum, you need two bank accounts for your studio or business: 1) a checking account for income and expenses and 2) a savings account for estimated taxes.

Additional bank accounts may include: retirement savings (investment account), health savings (HSA savings account), business reserves (basically an emergency fund for your business) and business profit (for investing back in your business or paying yourself an annual bonus).

Once you have your accounts set up, it’s simply a matter of recording and tracking money that comes in and money that goes out. Here’s a monthly checklist:

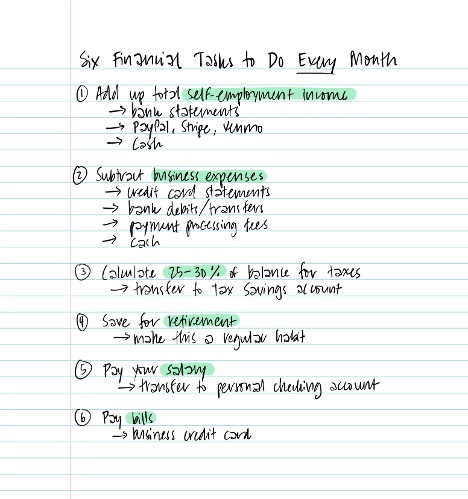

Six Financial Tasks to Do Every Month

- Add up your total self-employment income. Review your bank statements and PayPal, Stripe and/or Venmo accounts and track any cash you earn in your business.

- Subtract any business expenses (including payment fees). Review your credit card statements, bank debits or transfers, and track any cash you spend in your business. Check your PayPal, Stripe and Venmo accounts for payment processing fees.

- Calculate 25–30% of remaining balance for taxes. Transfer this to your tax savings account until it’s time to schedule your quarterly estimated tax payment (see next section).

- Save for retirement. Start early to reap the rewards of compound interest, even if you’re only able to set aside $50/month. Investing small amounts consistently over time is better than investing large amounts later. Make this a habit.

- Pay yourself a regular salary. This may be everything that’s left over (this is common for sole proprietors) or it may be a set amount that you transfer to your personal checking account each month, like a paycheck.

- Pay your bills. Try to pay off your business credit card each month and not carry a balance.

Quarterly—

Do You Need to Pay Estimated Tax?

If you work a traditional job (where you are hired as an employee), you know taxes are withheld from your paycheck. If you’re self-employed, the equivalent is paying estimated taxes each quarter.

What if your self-employment income is only part-time? How do you know if this applies to you?

Here’s what the IRS says: If you owe $1,000 (or more) in taxes at the end of the year, you need to pay quarterly estimated tax. (Source: irs.gov)

Said another way, if you make more than $3,000–$4,000 in self-employment or 1099 income (from adjudicating or other gigs), you should set aside 25–30% of that (after expenses) for estimated taxes, to be paid each quarter. That includes the amount you owe the federal government, plus what you owe your state (if your state charges income tax).

Here’s an example:

Let’s say you earn $6,000 in self-employment (and/or 1099) income. If you spend $1,000 on business-related expenses, your taxable income would be $5,000. At roughly 25%, that means you’d owe $1,250 in taxes for the year. That’s more than $1,000, so you should plan to make quarterly payments.

A note for LLC owners: By default, the IRS views single-member LLCs the same as sole proprietors, which means estimated tax is calculated the same way. Your business income gets passed through to your personal tax return and is reported on a Schedule C, just like if you were a sole proprietor.

How to Calculate (and Pay) Estimated Taxes

Your quarterly tax payments may differ in amount based on your earnings for that period. This is why it’s helpful to calculate your tax savings each month based on what you earned and spent. When it’s time to make an estimated tax payment, pay whatever is in your tax savings account.

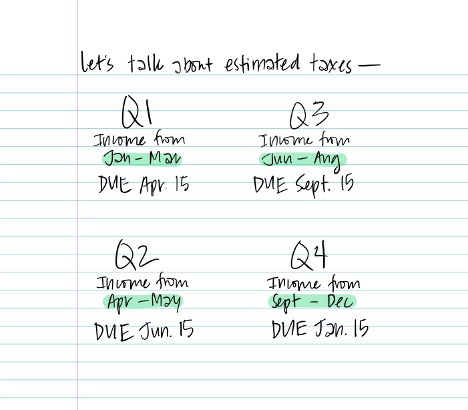

Make note of the following due dates (they’re not equal quarters!):

- Q1: Due April 15 (income earned January–March)

- Q2: Due June 15 (income earned April–May)

- Q3: Due September 15 (income earned June–August)

- Q4: Due January 15 (income earned September–December)

Estimated tax payments can be made online. For federal tax payments, visit eftps.gov. For state tax payments, visit your state or state tax website.

Annually—

Take Advantage of These Tax Write-Offs for Musicians

Tax write-offs (also called business write-offs or tax deductions) are things you spend money on that are directly related to your self-employment work or business: travel expenses, home office supplies, computer equipment, instrument maintenance and more—but again, only for your self-employment work, not costs associated with being an employee.

These are tax-deductible expenses, meaning the government subtracts them from your taxable income. Here’s an example:

Let’s say you made $30,000 in self-employment income this year. If you don’t have any expenses to report, the government will calculate your tax bill based on this full amount. If you spend $6,000 (20%) on business-related expenses, the government will subtract $6,000 from the $30,000 you earned when calculating your tax bill, so your taxable income will be only $24,000. This ends up saving you roughly 25% of whatever you spend on business expenses (in this case, $1,500!).

What Counts as a Write-Off?

Tax write-offs can be somewhat of an enigma. When in doubt, it’s always best to seek the advice from a certified tax professional familiar with your specific situation.

Here are seven noteworthy write-offs you may be able to claim as an independent music teacher or self-employed musician:

- Instrument maintenance and repair: New strings, felt or pads; a piano tuning; new reeds or rosin; bow repair; etc.

- Professional development: Conferences, workshops, lessons or classes, online courses and more.

Otherwise, if you use it 50% or more for business, you can write off a percentage of the purchase using the Section 179 deduction.

- Travel expenses: Airfare, mileage, public transportation and lodging costs are deductible if the travel is for your self-employment work or professional development.

- Meals: If you’re meeting with a client, student, teacher or colleague where work is discussed, those meals are 50% deductible, as is food for a board meeting. If you’re hosting a holiday party for your staff or employees, that’s 100% deductible, as are food and drinks provided free to the public (think concert reception). (Source: Bench)

- Mileage: Any mileage related to your self-employment (or independent contractor) work is deductible.

- Home office: If you’re self-employed and you work from home, you can write off a percentage of any home-related expenses (e.g., gutter cleaning, furnace/AC check, snow removal) and utility bills based on the size of your (dedicated) home office (even if it’s just part of a room).

Here are three things that don’t count as business write-offs:

- New clothes or performance outfits: To qualify as a tax write-off, clothing must be “ordinary and necessary” (think uniforms, costumes, protective gear, etc.). If it can be worn outside of work, it doesn’t count as a business expense.

- Mileage to and from your place of employment: If you receive a W-2 (as an employee), your mileage and other work-related expenses are not tax-deductible.

- Personal travel: If you’re teaching a master class in Hawai’i and then spending a week on vacation, only a fraction of your travel expenses is deductible.

Looking for more information on write-offs and strategic ways to use them as an independent music teacher? Here’s a blog post with 23+ business write-offs specifically for musicians.

Tax Basics Workbook

This free workbook includes: A 7-step tax prep work process + a checklist, a printable business expense worksheet, the working formula for calculating estimated tax payments (with all the math!), an estimated tax worksheet to use in your business, three estimated tax case studies to walk you through the calculations, a monthly task time checklist to help you stay organized.

Conclusion

In this article, we talked about how to:

- Do your own bookkeeping and keep good records as a self-employed musician

- Calculate and pay estimated tax in your business each quarter

- Take advantage of tax write-offs to lower your taxable income

You learned about how to set up your business bank accounts, six financial tasks to do each month, how and when to pay estimated taxes, and what counts as a business write-off (and what doesn’t).

I hope this information is helpful to you as you navigate the world of small business ownership. For more helpful insights for self-employed musicians, free resources, templates and support, visit www.musicianandcompany.com.

What is a Sole Proprietor?

A sole proprietor is someone who owns an unincorporated business by themselves. (Source: IRS)

Note: Unincorporated means the business is privately owned and not legally registered as a company.

As a sole proprietor, you are your business. That means you are responsible and liable for everything your business does. You are a sole proprietor by default when you start your business. You own 100% of your business and your business cannot function without you.

Pros:

- Freedom and control: You don’t report to anyone.

- Easy to manage: No setup, registration or ongoing paperwork is required.

Cons:

- Personal liability: If you get sued, your personal assets are at risk. You are personally responsible for everything your business does and any debt it incurs.

- Limited tax options: You cannot elect to be taxed as a corporation, which could save you money once you reach a certain income threshold.

What is an LLC?

An LLC (Limited Liability Company) is a hybrid business structure (in between a partnership and a corporation) regulated at the state level.

LLC owners (“members”) may be individuals, corporations, other LLCs, and foreign entities, each owning a certain percentage of the company. Most states also recognize single-member LLCs (only one owner). (Source: IRS)

If you’re a single-member LLC, you own 100% of your business (just like a sole proprietor) but your business can function independently. This also means you are not personally liable for your business.

Pros:

- Limited personal liability: Your personal assets are kept separate from your business.

- Tax benefits: You can elect to be taxed as a corporation (S-Corp), which may save you money once you reach a certain income threshold.

Cons:

- More paperwork: An LLC requires registration with your state, annual paperwork, and careful record-keeping throughout the year (including how and when you pay yourself). You cannot mix business and personal money.

- Added costs: There’s an upfront cost to registering an LLC and an annual fee to maintain it.

Learn more about these two business structures and how to choose what’s right for you in this post.

Ashley Danyew, PhD, is a piano teacher, writer, podcaster and entrepreneur. She is the founder and editor of Musician & Co. (www.musicianandcompany.com), helping classical musicians learn how to be small business owners.